Investing in crypto

In recent years, crypto has been growing in popularity, with many people treating it as an investment opportunity. But remember, if you decide to invest in crypto then you should be prepared to lose all the money you have invested.

On this page

Some cryptoassets appeal to investors based on the ethos of the developers and the use case for the token itself, while other investors may simply be speculating on the price history and volatility of the crypto.

A common phrase in the crypto community is ‘do your own research’ as it’s important to understand what you are buying and to be aware of scams which are commonplace and can target anyone. Investments in crypto can be complex, making it difficult to understand the risks associated with the investment.

While not all cryptos are same, they all pose high risks and are speculative as an investment. You should never invest money into crypto that you can’t afford to lose. If you decide to invest in crypto then you should be prepared to lose all your money. Read our article Crypto: The basics, to find out more.

Why has interest in crypto grown?

For many buyers, the main appeal of crypto is as a form of investment in an innovative digital asset. While some buy into crypto for short-term speculation, for others, owning cryptos can be viewed as a kind of diversification away from traditional assets, like shares, bonds or property.

Convenience and accessibility

Crypto supporters stress the benefits that the technology already offers consumers - like the ability to send crypto money online to family or friends across the world. For medium to large amounts this can often be done at much lower fees than conventional money transfer companies charge but sending smaller amounts may be more expensive and slower than traditional payment methods.

Alternatively, in developing countries that lack conventional banking systems, crypto could be directly available to consumers via their mobile phones, bypassing the need for the usual banking infrastructure - albeit they most likely still need to convert to normal currencies to make payments. Some developing countries’ national currencies may also be more volatile than cryptoassets, which can act as a better store of value, but crypto also cannot be relied on to hold its value which can make it difficult to value accurately, and therefore use as a payment method.

Reasons to be cautious when investing in crypto - markets are…

Volatile and unpredictable

Seeing the long-term potential in crypto is one thing but trying to put a value on them is another. Crypto prices can move suddenly with no warning – often more so than conventional assets like shares and bonds that are more widely held by investors - on the back of high-profile social media posts, or company or government-level announcements on crypto policies. Influencers may have been paid to promote a certain crypto on social media, whether the value is high or low. The price of many cryptos is primarily driven by whether other people are buying it, and therefore a post from an influencer can have a huge impact upon the price.

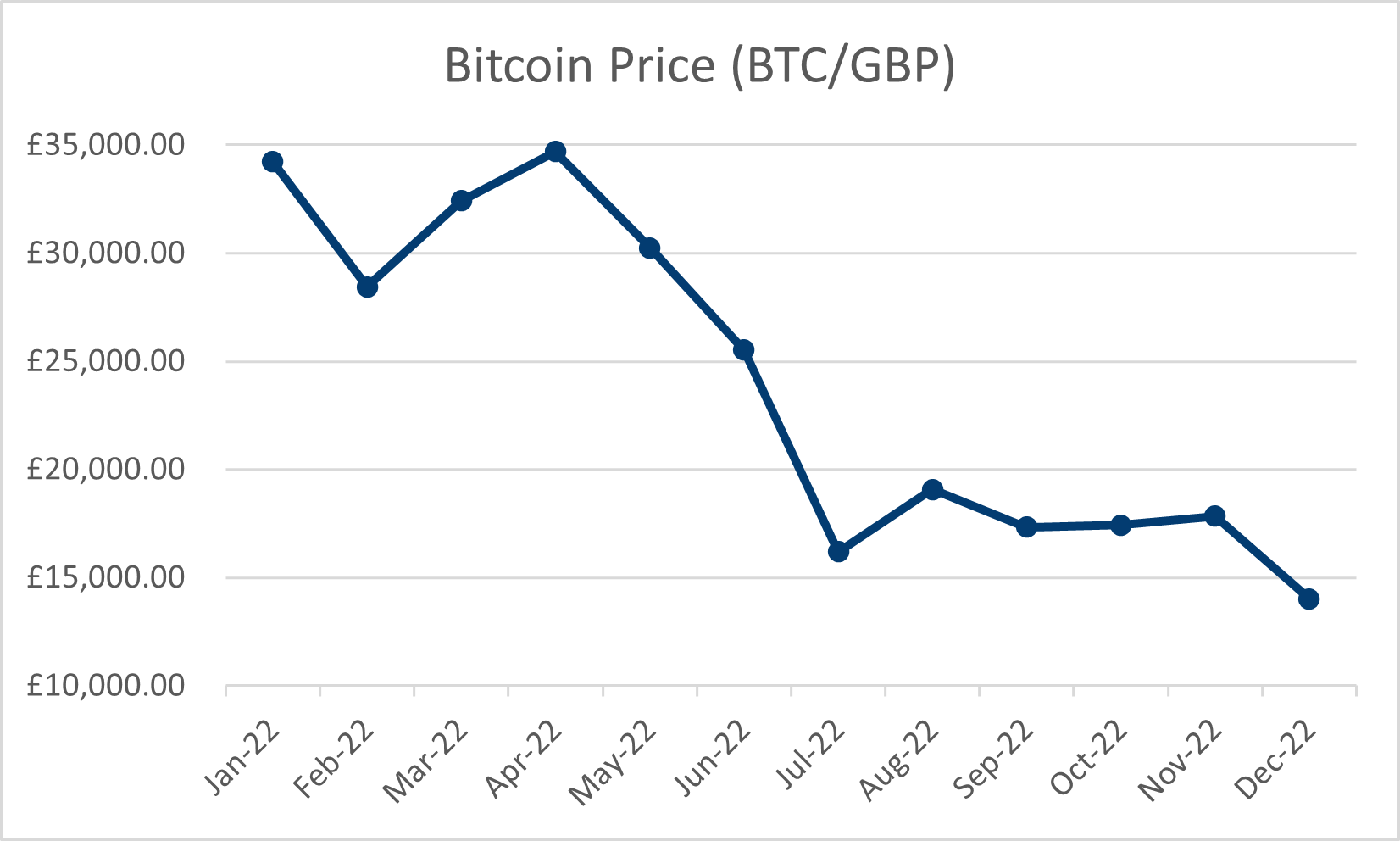

For example, the graph below depicts the volatile nature of Bitcoin in just one year.

The peak trading price of Bitcoin was in November 2021 when its value reached £51,032.02. At the end of December 2022, this had fallen by 73.12%, and value was £13,724.88. If you invested £300 at its peak, this would be worth £80.64 in December 2022.

Data sourced from CoinGecko

Even in the case of some stablecoins there have been instances where their value has become detached from the currency they are pinned to.

Largely unregulated

Most crypto-related activities are not regulated, as of yet, in the UK. It’s true that crypto businesses operating in the UK do have to register with us and abide by our anti-money laundering rules, as well as our new marketing rules. The marketing of crypto is regulated, and you can help protect yourself by recognising regulated crypto marketing.

If you don’t see these warnings and are offered an incentive to invest it means the company offering your investment isn’t following our rules, and could be illegal, or even a scam.

It’s important to remember that once your money is in the crypto ecosystem, there are no rules to protect it, unlike other investments.

So, if you make any crypto-related investments, you’re unlikely to have access to the Financial Services Compensation Scheme (FSCS) or the Financial Ombudsman Service (FOS) if something goes wrong.

High risk

Compared to markets like shares or forex, crypto is still in its infancy. In a developing market with lots of short-term speculative trading and prices particularly susceptible to news and events, the risk of being caught out by a big price move is very real.

Although the advanced encryption that secures cryptos themselves is difficult to breach, crypto is still vulnerable to cyber-attacks. Hackers have successfully stolen from crypto exchanges, and despite pledges by some exchanges to try to recover funds, this isn’t always possible, and many investors have been hit hard, losing a lot of money.

As with other kinds of high risk investments, anybody thinking about buying cryptoassets needs to fully understand all the risks as well as the opportunities involved. It is important not to throw everything you have into one investment opportunity. Learn more about diversification here.

Crypto is often highly volatile, being subject to sudden market moves, firm failure and poor segregation of client funds or cyberattacks are all a risk of investing in crypto.

If you decide to invest in crypto then you should be prepared to lose all your money.

However, if you do choose to invest, make sure it’s as part of a diversified portfolio with investments being no more than you can afford to lose.

Crypto: The basics

If you are thinking about buying crypto you need to know the basics

Understand the basicsRisk and Returns

What do we mean by risk and returns? And do you understand your risk profile?

Risks and returns